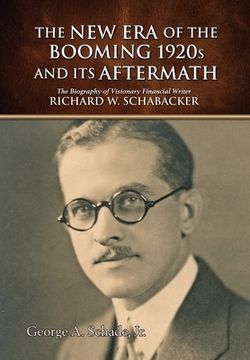

The New Era of The Booming 1920s And Its Aftermath: The Biography of Visionary Financial Writer Richard W. Schabacker (en Inglés)

Reseña del libro "The New Era of The Booming 1920s And Its Aftermath: The Biography of Visionary Financial Writer Richard W. Schabacker (en Inglés)"

A financial writer describes events and forces impacting national and global markets, renders an opinion as to their future direction, and offers advice. The 1920s saw the rise of financial writers who explained the booming stock market in what came to be called a "New Era," in which expectations were that no shadows darken the horizon. President Calvin Coolidge immortalized the catchphrase for the prosperity of the 1920s. Richard W. Schabacker, Princeton educated to be a writer, spent nearly a decade as Financial Editor for Forbes Magazine. He wrote 150 articles and nearly 300 columns that covered business conditions, stock market trends, interest rates, market psychology, rules of behavior, cycles, life on Wall Street, and common-sense investing. He educated investors and traders, and in the pursuit of that objective, he wrote two books and an investment course. He cautioned that all that is written about the stock market serves as the beginning of knowledge. For as long as we engage in financial markets, we must continue to study, plan, think, and learn from our experiences. Dick Schabacker was convinced that the Stock Market Crash of 1929 that ended talk of a New Era was not reason for investors and speculators to lose confidence in the stock market as an institution. The Crash and its aftermath moved him to concentrate on the technical analysis of financial markets. Technical factors use the empirical information derived from the actions of buyers and sellers in an open market. Research has shown that properly implemented technical analysis can increase profits and reduce the risks of investing. Yet, he did not favor one form of analysis over another. All factors that exert force in financial markets must be studied to glean a composite judgment. The prudent investor and successful speculator must use both fundamental and technical analysis. Favoring one to the exclusion of the other is like waiving a full set of weapons before entering the ba